Introduction home

link Try now

Try out how the Espago API works. Charge your first client followind these steps.

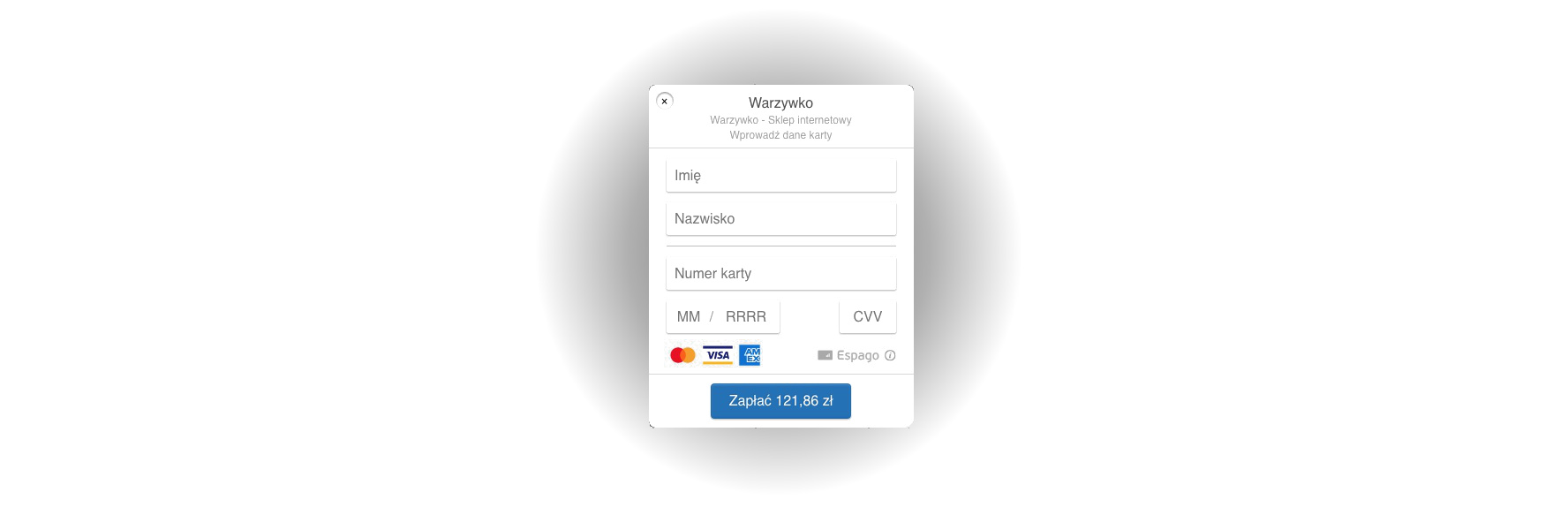

In the first step an iFrame is created, which serves the purpose of sending credit card information to the Espago Gateway. It then fetches the credit card token and submits it to a form.

You can use a mock credit card: 4242 4242 4242 4242, with the expiry date of 02/2025. The CVV code does not matter.

<!-- iFrame Configuration -->

<script

async=""

data-id="EspagoFrameScript"

data-key="VrYVaA1CjmRooKh63YYv"

data-live="false"

data-button="Pay"

src="https://js.espago.com/iframe.js">

</script>

<!-- Form with the credit card token -->

<form id="espago_form"

action="/charge_client"

accept-charset="UTF-8"

method="post">

</form>Next, the true request is sent to the Espago gateway. It consists of user information, the charged amount and currency among other information. Card input contains the credit card token generated by the IFrame.

curl -i https://sandbox.espago.com/api/charges \

-H "Accept: application/vnd.espago.v3+json" \

-u ms_771eUTliRiZ:SeCreT_P@ssw0rD \

-d "amount=10" \

-d "currency=pln" \

-d "card=[card_token]" \

-d "description=Espago docs"

Here is how the response will look like. It is sent using JSON formatting.Idandstateare pivotal. More on back requests

{

"id":"pay_7715NocOaPcNTL9O",

"description":"Espago docs",

"channel":"elavon",

"amount":"10.00",

"currency":"pln",

"state":"executed",

[...]

}

link Gateway Description

Security

In order to ensure a certain level of security is maintained, it is highly advised to use SSL (HTTPS) certificates on the merchants site. In every viable way of integrating, sensitive data regarding credit cards are sent directly from the client to the Espago gateway, excluding the Merchant’s site. This solution frees the Merchant from the responsibility associated with storing or processing credit card information, while PCI-DSS certification stays limited to filling out a questionnaire after signing a contract with Elavon.

The Architecture of Our API

Our API follows the principles of the REST architectural style. Every operations related to payment managment (status checks etc) have to be perfomed using API Requests (Application Programming Interface) - this very documentation focuses on explaining how to make use of our API. UTF-8 encoding is required in sent data. The API always generates answers in the JSON format.

Request time

A 40 second timeout (the maximal amount of time your site will wait for a response from Espago) is recommended for API requests, although the large majority of payments get processed in less than 2 seconds. We suggest to avoid calling any recurring payments at 3:30-5:30 CEST (01:30- 03:30 UTC) on working days, since we may be performing maintanance work on the Espago gateway.

link Integration methods

There are three ways of integrating with the Espago gateway for payments:

Attaching the iFrame to the merchant’s site

Using the iFrame script (for gathering credit card data) or a form with the use of Espago JS and performing the necessary payment operations through API requests (Read more)

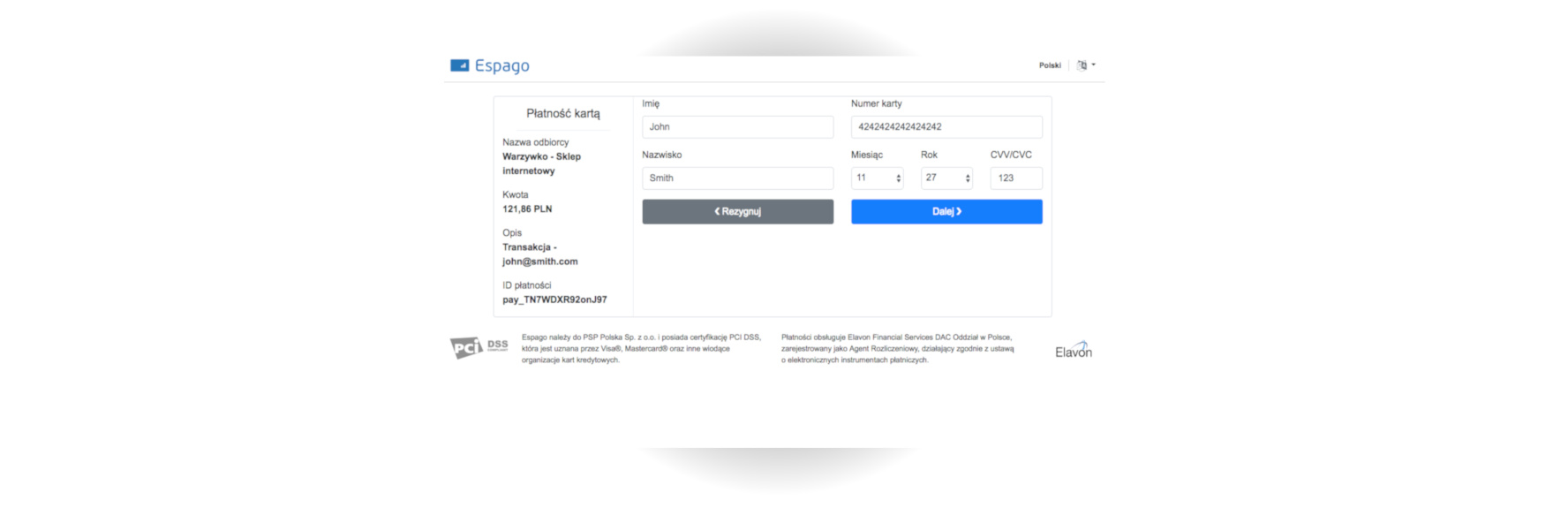

Redirecting clients to the Espago Secure Web Page

Redirecting clients with proper payment parameters. Receiving the response from the Espago gateway and taking care of the user, who’s redirected back to the mechant’s site. (Read more)

Integration through the Przelewy24 system

Espago/Elavon card payments can be one of many or the only payment method available for clients in Przelewy24. In this case integration with the Espago gateway is not necessary. The mechant has to integrate his site only with the Przelewy24 module.

This solution is greatly beneficient when:

- The merchant is also interested in receiving payments through regular/fast bank transfers

- The merchant uses a premade online store system (PrestaShop, Magento i inne) and is focused on quick and simple one-time payments

- The mechant already uses Przelewy24

link Changes and requirements resulting from PSD2

The Espago gateway provides the functions and mechanisms necessary to process payments in compliance with the PSD2 directive. From the perspective of merchants using card payments, the new requirements primarily include two elements:

1. Every online payment initiated by the customer utilizes strong customer authentication (SCA) provided by 3-D Secure;

2. Every subscription or card-on-file registration begins with an SCA payment, and subsequent payments are appropriately marked.

Failure to implement SCA will result in increased payment rejections for cards issued by European banks. It is the responsibility of the merchants to verify and adapt their integration to meet the new requirements.

- If you are currently using APIv3 with 3D Secure enabled for one-time payments, no changes are required.

- If you already process recurring payments using the “cof=storing” flag (feature added in August 2019), you most likely do not need to make any changes.

- If your application uses APIv3 without utilizing 3D Secure, this security feature must be enabled and used for all one-time payments and recurring payments.

- If you are still using the old APIv2, a migration to APIv3 is necessary.

- If you initiate recurring payments by creating a client profile with a separate request and double authorization, you need to modify the customer registration process to incorporate SCA.

PSD2-Related Change Checklist

To ensure compliance with PSD2 requirements regarding card acceptance, please perform the following checks:

| Question | Scope | Response: YES List of potential changes |

Response: NO List of potential changes |

|---|---|---|---|

| 1. Is your integration based on Espago API v3? | Applies to all clients. To verify if your integration uses API v3, check if you’re applying the appropriate request headers. | Yes - proceed to check if requirements from subsequent points are fulfilled; | No - you need to integrate with API v3: migrate from API v2; |

| 2. Are all cardholder-initiated payments (CIT) using strong customer authentication (SCA)? | Applies to all services. Strong customer authentication is provided through the 3-D Secure mechanism offered by Espago. | Yes - requirement fulfilled; | No - changes are required: - If API requests include the “skip_3ds” parameter for exemptions, it should be removed. If strong authentication is not possible due to the nature of the payment, utilize the moto mechanism (use the “moto” parameter in the API request). |

| 3. Are recurring, card-on-file, and merchant-initiated payments (MIT) preceded by strong customer authentication at the initiation stage? | Applies to services utilizing mechanisms such as: - Espago Subscriptions - Recurring, card-on-file, and other payments based on the card on file (COF) mechanism. |

Yes - requirement fulfilled; | No - you need to adjust the payment process to comply with the requirements described in the Multiple Payments or Espago Subscriptions section, depending on the mechanism used. Significant change - Client Profile (which can be used for subsequent charges) is created during the initiating payment with the cof=storing parameter, utilizing SCA. There is no need to create it with a separate client profile request. |

| 4. Was the client profile previously created based on the card token, before the first payment? | Applies to payments made using a saved client profile (including Espago Subscriptions). | Yes - changes are required to align with the requirements described in the Recurring Payments or Espago Subscriptions section. Although it is still possible to create a client profile without invoking SCA payment, in such cases, the first payment using that profile must utilize SCA or be marked as MOTO (it cannot be a recurring payment with the cof=recurring parameter). |

No - if a client profile created using the cof=storing payment is utilized, the requirement is fulfilled. |

| 5. Have you previously used the automatic card authorization mechanism (option selected in the secure.espago.com panel) when creating a client card token? | Applies to payments made using a saved client profile (including Espago Subscriptions). | Yes - you need to discontinue this option. We have introduced a different mechanism that allows you to determine whether a profile can be used for payments: If a client profile was created based on an SCA payment, it includes the sca_payment parameter, indicating a successfully authenticated payment. This serves as the basis for using the client profile for recurring and multiple charges. If the parameter is absent, the profile is not suitable for charges other than cardholder-initiated (with SCA) or MOTO payments. |

No - requirement fulfilled; |

| 6. Did the initial payment with 3DS or authorization return immediately upon saving the client card? | Applies primarily to merchants with recurring payments starting from a free trial period. | Yes - you need to modify the integration so that the initial SCA/3DS payment is not immediately reversed. Reversing the payment will be interpreted by the bank as revoking the customer’s consent for subsequent charges. To save the client card without charging it, use the cof=storing payment with an amount of 0 currency units. |

No - no changes are necessary; |

Integration assignment

link Integration process

linkIntegration with the test environment

Features which should be tested during the integration include:

- the creation of tokens,

- charging cards/creating payments

- displaying the reason of rejection to customers, when the payment is not successful,

- obtaining information about payment status,

- Reversal and refunding of the transaction (no need to implement these features at the beginning, but it’s very useful to test curl queries),

- The creation of customer profiles and managing them (if there is business need, for example in recurring payments or in stores where the customer returns and purchases can be repeated)

- recieving back-requests

Transitioning to the second and at the same time the last integration step requires you to firstly test your web application in the test environment and submit it to our Support Team for further inspection of your integration (espacially concerning the payment form).

The list of technical and general requirements of Elavon is available in this documentation under the ‘Downloads’ section. A test environment that can be used for viewing and setting parameters or inspecting test payments, requests and responses is available here: https://sandbox.espago.com

linkIntegration with the production environment

In order to switch over to the production environment you have to alter the connection parameters - 5 of them need to be changed:

- Gateway address

- App ID

- API password

- Public key

- the value of the ‘live’ parameter in the Espago constructor

After integrating into the production environment, the test environment still remains available to use for our clients. At the request of the Seller, the Espago Team can:

- Add a new service within the Seller’s account (eg. For any currencies)

- Enable / disable the ability to create and use plans and subscriptions (disabled by default)

- Enable / disable 3D-Secure (enabled by default) or DCC (disabled by default)

- Create a new user with access to the panel

- Provide answers and help solving problems associated with integration

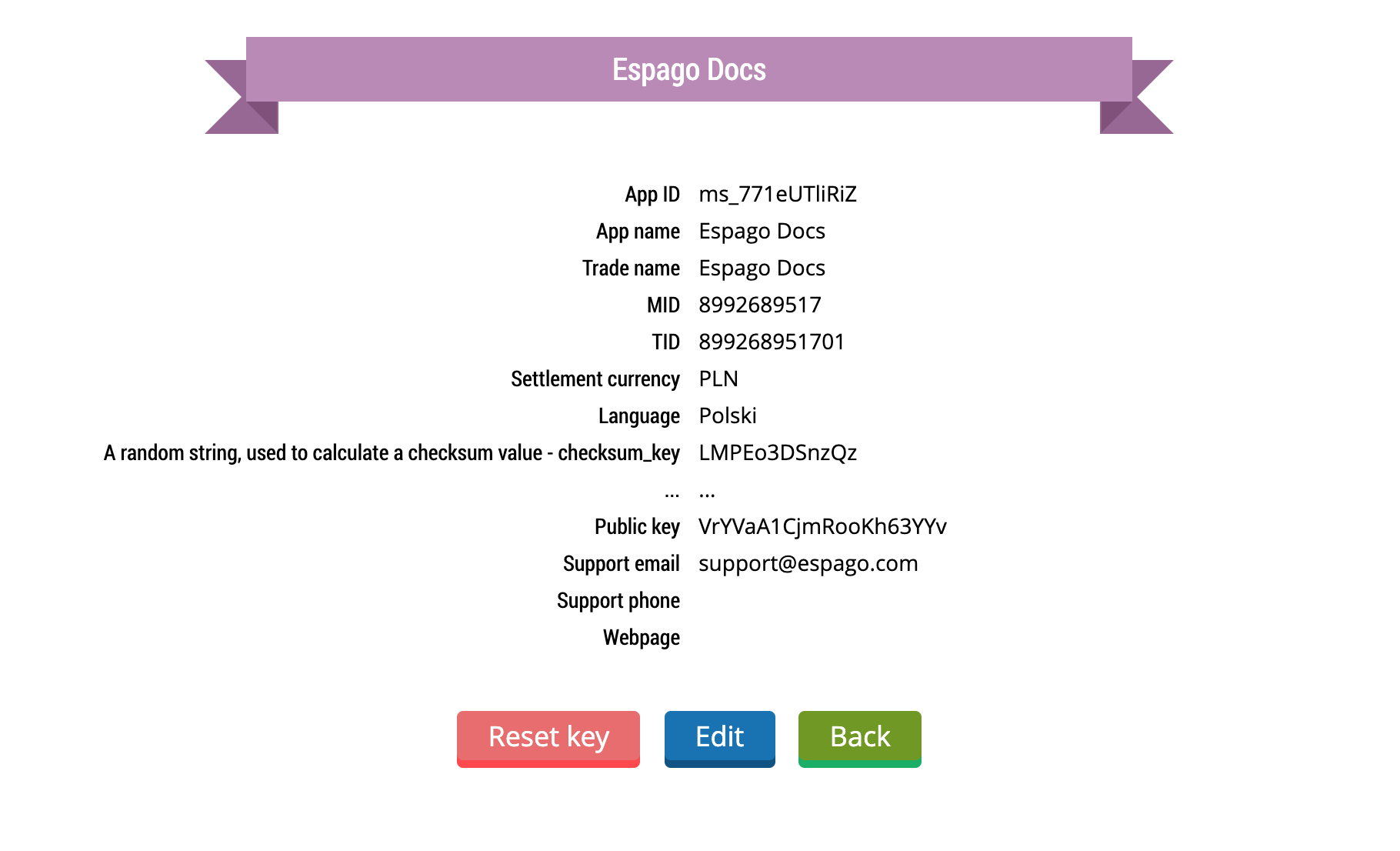

link First steps

After gaining access to the Merchant Panel, the following steps should be taken:

- Navigate to this page:

- Click on the ‘Edit’ button to access the site editing panel

- Fill in the ‘API password’ and ‘API password confirmation’ inputs - their value is responsible for the correct authorisation of your account and must not be shared with unauthorised persons. You have to also fill in the ‘Email BOK’ field

- Accept the changes by clicking on ‘Submit’.

Clicking on the ‘Show’ button should yield a similar result:

link Required request headers

For correct API requests, the following HTTP headers are used:

| Headers | Required | Value |

|---|---|---|

| Authorization1 | Required | Basic app_id:password |

| Accept | Required | application/vnd.espago.v3+json |

Requests for token creation are authorised with the use of a Public Key and for most services it is handled by Espago JS.

A series of unsuccessful log in attempts results in the account getting temporarily blocked.

Authorization1 - with the parameters of: APP_ID and the password fetched in the “First Steps” section. It concerns all API requests except for token creation.

link Test Cards Data

While testing your integration you need to use the data of the test cards mentioned below. To acheive successful or declined transaction you have to indicate specific card validation date and CVV - see the second and the third table below.

The use of real credit cards is forbidden.

| Card number | Brand | Currency | 3-D Secure | DCC | Required use during integration |

|---|---|---|---|---|---|

| 4012000000020006 | Visa | PLN | 3DSv2.1.0 Challenge |

No | Yes For one time payment and cof=storing |

| 4916978838794412 | Visa | PLN | 3DSv2.1.0 Frictionless: OK |

No | Yes |

| 4556914091330789 | Visa | PLN | 3DSv2.1.0 Frictionless: Reject |

No | Yes |

| 5432670000041258 | Mastercard | PLN | Mastercard SecureCode | No | Yes |

| 4242424242424242 | Visa | PLN | Yes | No | Yes |

| 4012001037141112 | Visa | PLN | Verified by Visa | No | No Since 2022-10 3DSv1 is disabled |

| 375987000000005 | American Express | PLN | Amex SafeKey | No | If Amex cards expected |

| 4012888888881881 | Visa | USD | Verified by Visa | Yes | If DCC expected |

| 5555555555554444 | Mastercard | HKD | Mastercard SecureCode | Yes | If DCC expected |

| 4242421111112239 | Visa | HKD | No | Yes | If DCC expected |

| 4917484589897107 | Visa | PLN | No | No | If COF payments expected - this card requires CVV code usage in every transaction. Not suited for the subscriptions and COF=recurring payments |

| 4916978838794412 | Visa | PLN | 3DSv2.1.0 [Frictionless OK] |

No | Recommended |

| 4556914091330789 | Visa | PLN | 3DSv2.1.0 [Frictionless Reject] |

No | Recommended |

| 4012000000020006 | Visa | PLN | 3DSv2.1.0 [Challenge] |

o | Yes, when testing cof=storing |

| 4012001038443335 | Visa | PLN | 3DSv2.1.0 Frictionless: OK |

No | No |

| 6771798021000008 | Maestro | PLN | 3DSv2.2.0 Frictionless: OK |

No | No |

The year of expiry is not important as long as it is a future date. You control the outcome of the payment by altering the month of expiry. Thanks to this feature, you are able to test both positive and negative scenarios.

| Month (expiration date) | Result | Issuer response code |

|---|---|---|

| 01-05 | Transaction accepted | 00 |

| 06 | Random outcome, 50% chance of succeeding. Useful while testing recurring payments. |

n/a |

| 07 | Transaction rejected | 04, 07, 41, 43 |

| 08 | Transaction rejected | 51 |

| 09 | Transaction rejected | 13 |

| 10 | Transaction rejected | 00 |

| 11 | Transaction rejected | 54 |

| 12 | Transaction rejected | 05, 57, 61 |

| CVV code | Result in the test gateway |

|---|---|

| 683 | Incorrect CVV. Transaction will be rejected due to incorrect CVV. |

| Other CVVs | Correct CVV. |

Rejection code control

Card 4012001038443335 allows Merchant to control rejection codes through transaction amount.

The rejection code takes the value of the transaction amount after the decimal point, for example:

| Decimal value | Rejection code |

|---|---|

| n.04 | 04 |

| n.51 | 51 |

| n.43 | 43 |

| n.65 | 65 |

Where n is a natural number.

link Test connection

To check your connection with Espago API You should send a request to https://sandbox.espago.com/api/test. In response you’ll get parameter state - value passed mean that your connection is configurated properly. Value failed means incorrect connection - then table warnings contains information about reasons of rejection.

Example request

curl -i https://sandbox.espago.com/api/test \

-H 'Accept: application/vnd.espago.v3+json' \

-u ms_771eUTliRiZ:SeCreT_P@ssw0rD

require 'net/http'

require 'uri'

require 'json'

class EspagoClient

# @param user [String]

# @param password [String]

def initialize(user:, password:)

@user = user

@password = password

end

# @param path [String]

# @param body [Hash, nil]

# @param method [Symbol]

# @return [Net::HTTPResponse]

def send(path, body: nil, method: :get)

uri = URI.join('https://sandbox.espago.com', path)

request = request_class(method).new(uri)

request.basic_auth(@user, @password)

request['Accept'] = 'application/vnd.espago.v3+json'

request['Content-Type'] = 'application/json'

request.body = body.to_json if body

Net::HTTP.start(uri.hostname, uri.port, use_ssl: true) do |http|

http.request(request)

end

end

private

# @param [Symbol]

# @return [Class<Net::HTTPRequest>]

def request_class(method_name)

Net::HTTP.const_get(method_name.to_s.capitalize)

end

end

client = EspagoClient.new(user: 'ms_771eUTliRiZ', password: 'SeCreT_P@ssw0rD')

response = client.send('api/test', method: :post)

puts response.body

$ch = curl_init();

curl_setopt($ch, CURLOPT_URL, 'https://sandbox.espago.com/api/test');

curl_setopt($ch, CURLOPT_RETURNTRANSFER, 1);

curl_setopt($ch, CURLOPT_CUSTOMREQUEST, 'GET');

curl_setopt($ch, CURLOPT_USERPWD, 'ms_771eUTliRiZ' . ':' . 'SeCreT_P@ssw0rD');

$headers = array();

$headers[] = 'Accept: application/vnd.espago.v3+json';

curl_setopt($ch, CURLOPT_HTTPHEADER, $headers);

$result = curl_exec($ch);

if (curl_errno($ch)) {

echo 'Error:' . curl_error($ch);

}

curl_close($ch);

{

"state":"passed",

"warnings":[]

}

{

"state":"failed",

"warnings":[

{

"title":"Access denied",

"message":"Wrong app_id or password."

},

{

"title":"Wrong request headers",

"message":"Check your 'Accept' header."

},

. . .

]

}

link Constraints

The purpose of the API is to not limit in any way the technology used by merchant’s services, in which payments are to be integrated, as well as devices from which customers will make payments. Nevertheless, there are some requirements during communication with Espago gateway, and it results in some limitations of compatibility with older technologies:

Espago gateway requires connections using TLSv1.1 or TLSv1.2 with strong ssl ciphers. Every requirement and configuration about SSL/TLS is first implemented on our test gateway https://sandbox.espago.com. If your app works fine in the test environment, it will also work in the production environment (and connect with the production gateway)

Some olders systems, libraries or browsers doesn’t support this connections, and need to by upgraded - This requirement applies to connections to API, 3D-Secure redirections and access to WWW panel.

List of software that supports TLS 1.2 and TLSv1.1

| System/ application/ library | The minimum compatible version | Additional notes |

|---|---|---|

| Windows | 7 and later | In Windows XP and Vista customer need to use alternative web browser (ie. Chrome, Firefox, Opera) |

| Windows Server | 2008 R2 and later | Windows 2008 R2 requires enabling TLSv1.2 in systems registry and enabling additional ssl ciphers |

| Android | 4.4.4 and later | Android API level 20. Partial support available also in 4.2 |

| OpenSSL | 1.0.1 and later | Note: OpenSSL 0.9.8 (all subversion) does not support TLSv1.2 |

| Apache | 2.2.23 and later | |

| Java | 8 and later | Note: Java 6 and Java 7 does not support TLSv1.2 |

| .NET Framework | 4.5.1 and later | enabling in preferences may be needed, and it requires Windows that supports TLSv1.2 |

List of protocols and ssl ciphers allowing secure connection to the Espago gateway

It is recommended to configure the application to permit connections using the safest available protocols and ciphers, and to have the opportunity to connect with several sets of codes (ie. not forcing one specific one cipher).

| Protocol | Ciphers |

|---|---|

| TLSv1.3 | TLS_AES_128_GCM_SHA256 TLS_AES_256_GCM_SHA384 TLS_CHACHA20_POLY1305_SHA256 |

| TLSv1.2 | ECDHE-ECDSA-AES128-GCM-SHA256 ECDHE-RSA-AES128-GCM-SHA256 ECDHE-ECDSA-AES256-GCM-SHA384 ECDHE-RSA-AES256-GCM-SHA384 ECDHE-ECDSA-CHACHA20-POLY1305 ECDHE-RSA-CHACHA20-POLY1305 |

Secure web page exit_to_app

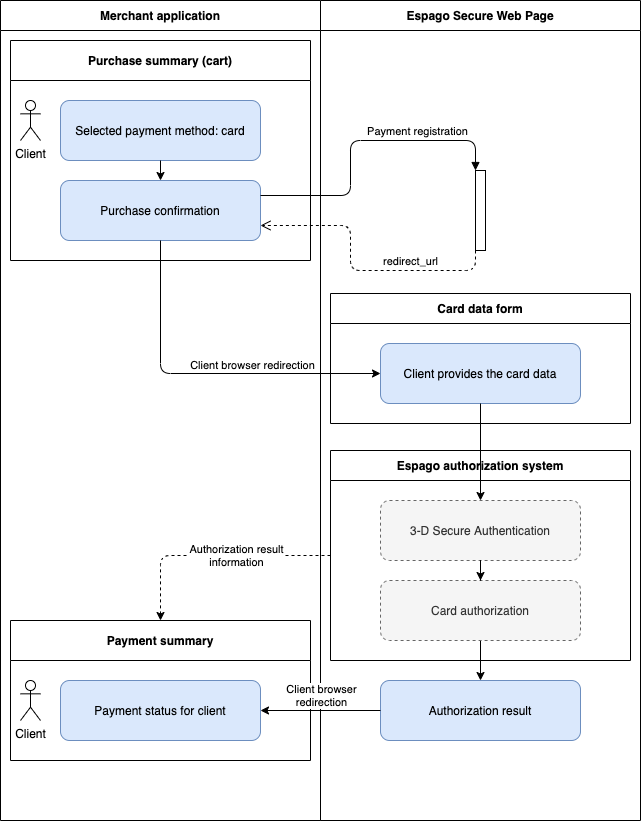

link Payment initialization

There are two ways to initiate a payment using the secure payment page:

1. HTML form request - by sending from the user’s browser a form containing payment data and a checksum to the / secure_web_page address;

2. Registering the payment in API - registering the payment through sending a POST request to the Espago API endpoint: / api / secure_web_page_register. After registering the payment, it is necessary to redirect the user to the URL address received in response - in the redirect_url parameter.

link Payment initialized using the HTML form

_secure_web_page.png)

1. Submitting the form

By clicking on the submit button, the client sends a HTML form with hidden fields containing the payment details, through the POST method, to the Espago gateway and gets redirected to the secure web page.

<form accept-charset="UTF-8" action="https://sandbox.espago.com/secure_web_page" id="espago_secure_web_page" method="post">

<input name="api_version" type="hidden" value="3" />

<input name="app_id" type="hidden" value="ms_771eUTliRiZ" />

<input name="kind" type="hidden" value="sale" />

<input name="session_id" type="hidden" value="1559655843622983577" />

<input name="amount" type="hidden" value="10.00" />

<input name="currency" type="hidden" value="PLN" />

<input name="title" type="hidden" value="payment_id:294" />

<input name="description" type="hidden" value="Platność - Jan Kowalski" />

<input name="positive_url" type="hidden" value="http://example.com/payments/ok" />

<input name="negative_url" type="hidden" value="http://example.com/payments/bad" />

<input name="ts" type="hidden" value="1444044688" />

<input name="checksum" type="hidden" value="938ee2f7729ac4ba1a7c98f5ead8b167" />

<button name="button" type="submit" class="btn espago-blue pulse">Pay</button>

</form>

2. Charging the client

The client fillings the card data form and the payment with 3-D Secure strong authentication is proceeded. When the authorization is completed, a back request is sent to the merchant service with the authorization details.

3. Redirecting to the merchant

Depending upon the payment status, the client gets redirected to one of the two URLs (for the positive or negative authorization result). The merchant service should display the payment status and if the payment is rejected - also a recejt reason..

link Example form

The Secure Web Page method of payment handles most of thew work for you by redirecting the client to the Espago Gateway where they will enter their credit card data. They then get charged the correct amount and get redirected back to your site. You can see a demo in action here: demo.espago.com

You can use a test card with the number: 4242 4242 4242 4242; and expiry date of 02/2025. The CVV number does not matter. (More on test cards)

link Form parameters

Payment parameters are sent through the POST method on the following URL:

sandbox URL: https://sandbox.espago.com/secure_web_page

URL: https://secure.espago.com/secure_web_page

| Parameter | Description | Required | Notes | |

|---|---|---|---|---|

api_version |

API version | done | 3 | |

app_id |

Application ID | done | ||

kind |

Type of transaction | done | sale or preauth(hold certain amount of money on customer’s card and charge it later) | |

session_id |

merchant session ID/transaction ID | done | Random, unique character string generated by the Merchant | |

amount |

transaction amount | done | two decimal places, separated by a dot eg. 10.00, 1.23, 1.20 |

|

currency |

currency | done | ||

title |

transaction description | done | Payment description - will be displayed as a payment title at the top of payment card form, e.g. ‘Order 123/2019’. Should be between 5 and 100 characters. The ‘title’ parameter from the form will be available as the payment parameter ‘description’ (eg. in the back request). |

|

description |

client description | Description of the customer, not the payment. | ||

email |

client’s email | done | E-mail of the client, required for 3D Secure authentication. A confirmation email will be sent to this address. | |

skip_email |

Boolean (false/true, default: false). | Disables email notifications - even if you send a request charge with a customer profile with an email address | ||

payment_methods |

channel for specific payment methods | Structure that allows you to define the channel for each payment method. New parameter that replaces channel parameter. Examples: payment_methods[blik][channel] = 'p24_blik' or payment_methods[card][channel] = 'elavon_cc'. Available payment methods are: card, apple_pay, google_pay, blik. |

||

positive_url |

URL | URL to which the client will be forwarded after the correct transaction processing | ||

negative_url |

URL | URL to which the client will be forwarded in case of a transaction error | ||

locale |

transaction language | pl, en, da, ru, sv |

||

reference_number |

reference number | Trans ref text - visible in Elavon reports. Length up to 20 characters, only alphanumeric and -_ (minus and bottom bar). |

||

channel |

Payment channel | Payment channel for this payment request. Defaut value is “elavon_cc” | ||

ts |

timestamp | done | ||

checksum |

checksum | done | MD5 checksum for a string comprised of payment parameters (app_id + kind + session_id + amount + currency + ts + checksum_key). The fields’ separator: “|” | |

An example of the form:

<form id="espago_secure_web_page" action="https://sandbox.espago.com/secure_web_page" accept-charset="UTF-8" method="post">

<input type="hidden" name="api_version" value="3" />

<input type="hidden" name="app_id" value="ms_0CvDQqhnS" />

<input type="hidden" name="kind" value="sale" />

<input type="hidden" name="session_id" value="2HWSjEs5G4RcXZjqHqWA" />

<input type="hidden" name="amount" value="42.94" />

<input type="hidden" name="currency" value="PLN" />

<input type="hidden" name="title" value="order_165" />

<input type="hidden" name="description" value="Transaction - john@smith.com 42.94" />

<input type="hidden" name="email" value="john@smith.com" />

<input type="hidden" name="positive_url" value="http://example.com/payments/ok" />

<input type="hidden" name="negative_url" value="http://example.com/payments/bad" />

<input type="hidden" name="payment_methods[card][channel]" value="elavon_cc" />

<input type="hidden" name="ts" value="1559230283" />

<input type="hidden" name="checksum"value="532839977fb76ca06ea635c7a936c7db" />

<div class="button">

<button name="button" type="submit">Buy now!</button>

</div>

</form>

link Payment initialization through API request

To initiate a payment using a Secure Web Page, send a request to the API using the POST method, and then redirect the customer to the URL received in the response - in the redirect_url parameter.

The API initialized secure web page payment process:

In this endpoint the same parameters as in API “charge” method are used. An exception is the cof parameter, which in this case can only take the values storing and payment_methods.

| Parameter | Description | Required | Notes |

|---|---|---|---|

payment_methods |

channel for specific payment methods | Structure that allows you to define the channel for each payment method. New parameter that replaces channel parameter. Available payment methods are: card, apple_pay, google_pay, blik. Example: payment_methods: { card: { channel: { "elavon_cc" } } } |

Request params

Ścieżka:/api/secure_web_page_register

Metoda:POST

curl -i https://sandbox.espago.com/api/secure_web_page_register /

-X POST \

-H 'Accept: application/vnd.espago.v3+json' \

-u app_id:password \

-d 'amount=199' \

-d 'currency=PLN' \

-d 'description=Payment_123' \

-d 'kind=sale' \

require 'net/http'

require 'uri'

require 'json'

class EspagoClient

# @param user [String]

# @param password [String]

def initialize(user:, password:)

@user = user

@password = password

end

# @param path [String]

# @param body [Hash, nil]

# @param method [Symbol]

# @return [Net::HTTPResponse]

def send(path, body: nil, method: :get)

uri = URI.join('https://sandbox.espago.com', path)

request = request_class(method).new(uri)

request.basic_auth(@user, @password)

request['Accept'] = 'application/vnd.espago.v3+json'

request['Content-Type'] = 'application/json'

request.body = body.to_json if body

Net::HTTP.start(uri.hostname, uri.port, use_ssl: true) do |http|

http.request(request)

end

end

private

# @param [Symbol]

# @return [Class<Net::HTTPRequest>]

def request_class(method_name)

Net::HTTP.const_get(method_name.to_s.capitalize)

end

end

client = EspagoClient.new(user: 'ms_771eUTliRiZ', password: 'SeCreT_P@ssw0rD')

response = client.send(

'api/secure_web_page_register',

method: :post,

body: {

amount: 199,

currency: 'PLN',

description: 'Opis transakcji',

kind: 'sale',

service_client_id: 'xxxxxx',

client_description: 'xxxxx'

}

)

puts response.body

$ch = curl_init();

curl_setopt($ch, CURLOPT_URL, 'https://sandbox.espago.com/api/secure_web_page_register');

curl_setopt($ch, CURLOPT_RETURNTRANSFER, 1);

curl_setopt($ch, CURLOPT_POSTFIELDS, "amount=199¤cy=PLN&description=Payment_123&kind=sale&service_client_id=xxxxxx&client_description=xxxxx");

curl_setopt($ch, CURLOPT_POST, 1);

curl_setopt($ch, CURLOPT_USERPWD, 'app_id' . ':' . 'password');

$headers = array();

$headers[] = 'Accept: application/vnd.espago.v3+json';

$headers[] = 'Content-Type: application/x-www-form-urlencoded';

curl_setopt($ch, CURLOPT_HTTPHEADER, $headers);

$result = curl_exec($ch);

if (curl_errno($ch)) {

echo 'Error:' . curl_error($ch);

}

curl_close($ch);

{

"id": "pay_IZTq8l_qaHuOHH",

"description": "Payment_123",

"amount": "199",

"currency": "PLN",

"state": "new",

"created_at": 1550224439,

"transaction_id": "tn_CLN2HhetI",

"redirect_url": "https://sandbox.espago.com/secure_web_page/tn_CLN2HhetI"

}

iFrame open_in_browser

link The functioning of Espago iFrame

EspagoFrame script creates an iframe with a modal window where the customer can enter his credit card data. Next, the data is sent to Espago, and the script returns the token ID to the Merchant’s.

An example of this method of integration can be found on this test site demo.espago.com.

komunikacja_przez_iframe.png)

1. Calling the iFrame

In the first step the client calls the Espago iFrame clicking on a button (the call has to be made in your script, by the function called: showEspagoFrame()). Next, the client enters his credit card information, which get sent asynchronously to the Espago gateway in order to generate a token.

<script src="https://js.espago.com/espago-1.3.js"></script>

<script

async=""

data-id="EspagoFrameScript"

data-key="VrYVaA1CjmRooKh63YYv"

data-live="false"

data-button="Pay"

src="https://js.espago.com/iframe.js">

</script>

<a id="pay_btn">Zapłać</a>

document.querySelector('#pay_btn').onclick( () => {

showEspagoFrame()

})

2. Receiving tokens

After receiving the token, the Espago script searches for a form with an id of: espago_form, and creates a new input therein: <input type="hidden" id="card_token" name="card_token" value="[TOKEN]">. The form is then submitted to the designated URL.

<form id="espago_form"

action="/charge_client"

accept-charset="UTF-8"

method="post">

</form>

If the token was not used, the CVV code from the token will be automatically removed after a maximum of 2 days from creation, and the entire token after 2 months.

3. Charges

After receiving the token, the Merchant’s server should send a request with the POST method to the following URL: https://sandbox.espago.com/api/charges.

curl -i https://sandbox.espago.com/api/charges \

-H "Accept: application/vnd.espago.v3+json" \

-u ms_771eUTliRiZ:SeCreT_P@ssw0rD \ # app_id:pass

-d "amount=10" \

-d "currency=pln" \

-d "card=cc_8a1kqN20X6JYeuD-Y" \ # token

-d "description=Espago docs"

require 'net/http'

require 'uri'

require 'json'

class EspagoClient

# @param user [String]

# @param password [String]

def initialize(user:, password:)

@user = user

@password = password

end

# @param path [String]

# @param body [Hash, nil]

# @param method [Symbol]

# @return [Net::HTTPResponse]

def send(path, body: nil, method: :get)

uri = URI.join('https://sandbox.espago.com', path)

request = request_class(method).new(uri)

request.basic_auth(@user, @password)

request['Accept'] = 'application/vnd.espago.v3+json'

request['Content-Type'] = 'application/json'

request.body = body.to_json if body

Net::HTTP.start(uri.hostname, uri.port, use_ssl: true) do |http|

http.request(request)

end

end

private

# @param [Symbol]

# @return [Class<Net::HTTPRequest>]

def request_class(method_name)

Net::HTTP.const_get(method_name.to_s.capitalize)

end

end

client = EspagoClient.new(user: 'ms_771eUTliRiZ', password: 'SeCreT_P@ssw0rD')

response = client.send(

'api/charges',

method: :post,

body: {

amount: 10,

currency: 'PLN',

card: 'cc_8a1kqN20X6JYeuD-Y',

description: 'Espago docs'

}

)

puts response.body

$ch = curl_init();

curl_setopt($ch, CURLOPT_URL, 'https://sandbox.espago.com/api/charges');

curl_setopt($ch, CURLOPT_RETURNTRANSFER, 1);

curl_setopt($ch, CURLOPT_POSTFIELDS, "amount=10¤cy=pln&card=cc_8a1kqN20X6JYeuD-Y&description=Espago docs");

curl_setopt($ch, CURLOPT_POST, 1);

curl_setopt($ch, CURLOPT_USERPWD, 'ms_771eUTliRiZ' . ':' . 'SeCreT_P@ssw0rD');

$headers = array();

$headers[] = 'Accept: application/vnd.espago.v3+json';

$headers[] = 'Content-Type: application/x-www-form-urlencoded';

curl_setopt($ch, CURLOPT_HTTPHEADER, $headers);

$result = curl_exec($ch);

if (curl_errno($ch)) {

echo 'Error:' . curl_error($ch);

}

curl_close ($ch);

4. The response from Espago

After a successful charge request, Espago returns data about the current payment in JSON formatting. The state parameter is key. executed means that the payment has succeded.

Example of a response from Espago:

{

"id":"pay_772FThyrtalisvgk",

"description":"Espago docs",

"channel":"elavon",

"amount":"10.00",

"currency":"pln",

"state":"executed",

"client":"cli_772coQy1BaW3F0Zn",

"created_at":1559649971,

"card":

{

"company":"VI",

"last4":"4242",

"year":2020,

"month":2,

"first_name":"Adam",

"last_name":"Kowalski",

"authorized":null,

"created_at":1559649956

},

"issuer_response_code":"00",

"reversable":true,

"transaction_id":"tr_7728ogw8v"

}

5. Response - information for the client

After completing the payment it is necessery to inform your clients about the status of their transaction, together with the reason of rejection (if that is the case). Error codes are available in the ‘Downloads’ section.

link iFrame parameters

| Parameter | Required? | Default value | Meaning |

|---|---|---|---|

| async | done | “” | No other values are permitted |

| data-id | done | EspagoFrameScript | No other values are permitted |

| src | done | Script URL | No other values are permitted |

| data-key | done | String, Merchant’s public key | |

| data-live | true | String, If ‘true’, then requests are sent to production environment. If set to ‘false’, requests are sent to test environment. | |

| data-lang | pl | String, Form language (for default labels, placeholders) in ISO 639-1 standard. Available: en, pl, bg, cs, da, de, el, es, et, fi, fr, ga, hr, hu, it, lt, lv, mt, nl, no, pt, ro, ru, sk, sl, sv, ua. | |

| data-success | function(data) {} | A callback function called when the token gets generated. Caution, defining a callback function disables the default action of our script - the ‘card_token’ field will not be appended to the form. data - string, a generated token from the Espago gateway. |

|

| data-error | function(data) {} | A callback function called when token generation failed. data - string; Error code received from the Espago gateway together with a description. |

|

| data-onclose | function() {} | A function called when the user closes the dialogue window (by clicking on ‘x’ or pressing ‘Esc’). | |

| data-target | espago_form | Name of the form to which the ‘card_token’ field will be appended. Caution - if you decide to submit the form with the ‘success_callback’ parameter, this action will not take place. The token will be submited to this function. |

|

| data-title | Add your card (en) | Form title. Note - The default value depends on the language value of ‘data-lang’. |

|

| data-subtitle | The text displayed below the form title and store name (store name is taken automatically from the API Espago). | ||

| data-button | Save (en) | The label that will be displayed inside the form submitting button. Note - The default value depends on the language value of ‘data-lang’. |

|

| data-styler | esp | String, Optional form styling. If a special version of the iframe has been prepared for the Merchant, after including the iframe parameter, it will be displayed in the ordered graphic design. The styling option is only available after prior arrangement with Espago. |

iFrame 3.0 present_to_all

link Functioning of iFrame 3.0

EspagoFrame script allows you to display a Secure Web Page on the seller’s website inside an iframe, where the customer will be able to complete the payment process without additional redirections. Special frame will be displayed in which the customer can safely add card details or use another payment method to complete the transaction.

A sample operation can be seen in our test store demo.espago.com.

1. Payment initiation

Before the customer proceeds to the payment process, merchant must initiate it in the Espago system. To do this, send `POST` request from the server to the path `/api/charges/init`. Detailed information on payment initiation is provided in the subsection Payment initiation.

curl -i https://sandbox.espago.com/api/charges/init \

-X POST \

-H 'Content-Type: application/json' \

-H 'Accept: application/vnd.espago.v3+json' \

-u ms_771eUTliRiZ:SeCreT_P@ssw0rD \

-d '{ "amount": 10, "currency": "PLN", "description": "docs test charge init" }'

require 'net/http'

require 'uri'

require 'json'

class EspagoClient

# @param user [String]

# @param password [String]

def initialize(user:, password:)

@user = user

@password = password

end

# @param path [String]

# @param body [Hash, nil]

# @param method [Symbol]

# @return [Net::HTTPResponse]

def send(path, body: nil, method: :get)

uri = URI.join('https://sandbox.espago.com', path)

request = request_class(method).new(uri)

request.basic_auth(@user, @password)

request['Accept'] = 'application/vnd.espago.v3+json'

request['Content-Type'] = 'application/json'

request.body = body.to_json if body

Net::HTTP.start(uri.hostname, uri.port, use_ssl: true) do |http|

http.request(request)

end

end

private

# @param [Symbol]

# @return [Class<Net::HTTPRequest>]

def request_class(method_name)

Net::HTTP.const_get(method_name.to_s.capitalize)

end

end

client = EspagoClient.new(user: 'ms_771eUTliRiZ', password: 'SeCreT_P@ssw0rD')

response = client.send(

'api/charges/init',

method: :post,

body: {

amount: 199,

currency: 'PLN',

description: 'Opis transakcji'

}

)

puts response.body

$ch = curl_init();

curl_setopt($ch, CURLOPT_URL, 'https://sandbox.espago.com/api/charges/init');

curl_setopt($ch, CURLOPT_RETURNTRANSFER, 1);

curl_setopt($ch, CURLOPT_POSTFIELDS, "amount=199¤cy=PLN&description=Payment_123");

curl_setopt($ch, CURLOPT_POST, 1);

curl_setopt($ch, CURLOPT_USERPWD, 'app_id' . ':' . 'password');

$headers = array();

$headers[] = 'Accept: application/vnd.espago.v3+json';

$headers[] = 'Content-Type: application/x-www-form-urlencoded';

curl_setopt($ch, CURLOPT_HTTPHEADER, $headers);

$result = curl_exec($ch);

if (curl_errno($ch)) {

echo 'Error:' . curl_error($ch);

}

curl_close($ch);

{

"id": "pay_IZTq8l_qaHuOHH",

"description": "Payment_123",

"amount": "199",

"currency": "PLN",

"state": "new",

"created_at": 1550224439,

"transaction_id": "tn_CLN2HhetI",

"payment_token": "573cf230-13df-4641-8d92-90c8b69173d0"

}

2. EspagoFrame initialization

On the page where the button that invoke Secure Web Page iframe will be placed, create and initialize the EspagoFrame object by passing the payment parameters to it. Then you need to create an event listener for clicking the button, which will call the open() method. For this method, it is necessary to provide further callbacks functions as parameters for process finalization, error or closing of the iframe.

<script src="https://js.espago.com/espagoFrame.js"></script>;

<script lang="text/javascript">

const onPaymentResult = function (result) {

console.log(`Payment ${result.payment_id} finished with state ${result.state}`);

};

const onError = function (errorMessage) {

console.log("Something went wrong: " + errorMessage);

};

const onClose = function () {

console.log("Modal closed.");

};

const espagoFrame = new EspagoFrame({

key: "merchantPublicKey123",

env: "sandbox",

payment: "pay_123123123",

token: "aa111a11-111-1aa1-aa11-a11aaa111111"

})

espagoFrame.init();

document.querySelector('#pay_btn').onclick( () => {

espagoFrame.open({

onPaymentResult: onPaymentResult,

onError: onError,

onClose: onClose

});

});

</script>

3. Completing payment process by the client

W drugim kroku klientowi wyświetli się iFrame, w którym dokona dokończenia procesu płatności poprzez podanie danych karty i autoryzację lub wykorzysta inny ze sposobów zapłaty. In next step, EspagoFrame will be shown in which customer need to complete the payment process by providing card details and authorization, or by using another payment method.

4.Returning the payment result

After the process is completed, EspagoFrame is closed and the function assigned as a callback after receiving the payment status (onPaymentResult) is invoked. The result obtained in this way returns the payment ID and its status. To get full information about transaction result, merchant have to send an additional request to Espago.

{

"id":"pay_772FThyrtalisvgk",

"state":"executed"

}

5. Transaction details

Before displaying full information about the payment progress to the client, server have to send a request to Espago for payment details. More information about transaction details request here.

curl -i https://sandbox.espago.com/api/charges/pay_771MKFI-15SIK1Pm \

-H 'Accept: application/vnd.espago.v3+json' \

-u ms_771eUTliRiZ:SeCreT_P@ssw0rD

require 'net/http'

require 'uri'

require 'json'

class EspagoClient

# @param user [String]

# @param password [String]

def initialize(user:, password:)

@user = user

@password = password

end

# @param path [String]

# @param body [Hash, nil]

# @param method [Symbol]

# @return [Net::HTTPResponse]

def send(path, body: nil, method: :get)

uri = URI.join('https://sandbox.espago.com', path)

request = request_class(method).new(uri)

request.basic_auth(@user, @password)

request['Accept'] = 'application/vnd.espago.v3+json'

request['Content-Type'] = 'application/json'

request.body = body.to_json if body

Net::HTTP.start(uri.hostname, uri.port, use_ssl: true) do |http|

http.request(request)

end

end

private

# @param [Symbol]

# @return [Class<Net::HTTPRequest>]

def request_class(method_name)

Net::HTTP.const_get(method_name.to_s.capitalize)

end

end

client = EspagoClient.new user: 'ms_771eUTliRiZ', password: 'SeCreT_P@ssw0rD'

payment_id = 'pay_8a1Wx0ggKxvxxmv1'

response = client.send "api/charges/#{payment_id}", method: :get

puts response.body

$ch = curl_init();

curl_setopt($ch, CURLOPT_URL, 'https://sandbox.espago.com/api/charges/pay_771MKFI-15SIK1Pm');

curl_setopt($ch, CURLOPT_RETURNTRANSFER, 1);

curl_setopt($ch, CURLOPT_CUSTOMREQUEST, 'GET');

curl_setopt($ch, CURLOPT_USERPWD, 'ms_771eUTliRiZ' . ':' . 'SeCreT_P@ssw0rD');

$headers = array();

$headers[] = 'Accept: application/vnd.espago.v3+json';

curl_setopt($ch, CURLOPT_HTTPHEADER, $headers);

$result = curl_exec($ch);

if (curl_errno($ch)) {

echo 'Error:' . curl_error($ch);

}

curl_close($ch);

{

"id": "pay_771MKFI-15SIK1Pm",

"description": "Espago docs",

"channel": "elavon",

"amount": "10.00",

"currency": "PLN",

"state": "executed",

"client": "cli_771Xsyr9GkpN8iTp",

"created_at": 1559130872,

"card": {

"company": "VI",

"last4": "4242",

"year": 2024,

"month": 9,

"first_name": "Adam",

"last_name": "Nowak",

"authorized": null,

"created_at": 1612977801

},

"issuer_response_code": "00",

"reversable": true,

"transaction_id": "tr_771EQhf18",

"reference_number": "Test_doc"

}

6. Response - information for the client

After completing the payment and receiving detailed information about the transaction, it is necessary to display its status to the customer along with the reject reason in case of failure. Error codes are available in the download section.

link Payment initialization

Initiating a payment is performed using the same parameters as in the case of API Charge. The exception is the parameter cof, which in this case may only take the value storing and parameter payment_methods.

| Parameter | Description | Required | Notes |

|---|---|---|---|

payment_methods |

channel for specific payment methods | Structure that allows you to define the channel for each payment method. New parameter that replaces channel parameter. Available payment methods are: card, apple_pay, google_pay, blik. Example: payment_methods: { card: { channel: { "elavon_cc" } } } |

Request params

Path:/api/charges/init

Method:POST

curl -i https://sandbox.espago.com/api/charges/init \

-X POST \

-H 'Content-Type: application/json' \

-H 'Accept: application/vnd.espago.v3+json' \

-u ms_771eUTliRiZ:SeCreT_P@ssw0rD \

-d '{ "amount": 10, "currency": "PLN", "description": "docs test charge init"} }'

require 'net/http'

require 'uri'

require 'json'

class EspagoClient

# @param user [String]

# @param password [String]

def initialize(user:, password:)

@user = user

@password = password

end

# @param path [String]

# @param body [Hash, nil]

# @param method [Symbol]

# @return [Net::HTTPResponse]

def send(path, body: nil, method: :get)

uri = URI.join('https://sandbox.espago.com', path)

request = request_class(method).new(uri)

request.basic_auth(@user, @password)

request['Accept'] = 'application/vnd.espago.v3+json'

request['Content-Type'] = 'application/json'

request.body = body.to_json if body

Net::HTTP.start(uri.hostname, uri.port, use_ssl: true) do |http|

http.request(request)

end

end

private

# @param [Symbol]

# @return [Class<Net::HTTPRequest>]

def request_class(method_name)

Net::HTTP.const_get(method_name.to_s.capitalize)

end

end

client = EspagoClient.new(user: 'ms_771eUTliRiZ', password: 'SeCreT_P@ssw0rD')

response = client.send(

'api/charges/init',

method: :post,

body: {

amount: 199,

currency: 'PLN',

description: 'Opis transakcji'

}

)

puts response.body

$ch = curl_init();

curl_setopt($ch, CURLOPT_URL, 'https://sandbox.espago.com/api/charges/init');

curl_setopt($ch, CURLOPT_RETURNTRANSFER, 1);

curl_setopt($ch, CURLOPT_POSTFIELDS, "amount=199¤cy=PLN&description=Payment_123");

curl_setopt($ch, CURLOPT_POST, 1);

curl_setopt($ch, CURLOPT_USERPWD, 'app_id' . ':' . 'password');

$headers = array();

$headers[] = 'Accept: application/vnd.espago.v3+json';

$headers[] = 'Content-Type: application/x-www-form-urlencoded';

curl_setopt($ch, CURLOPT_HTTPHEADER, $headers);

$result = curl_exec($ch);

if (curl_errno($ch)) {

echo 'Error:' . curl_error($ch);

}

curl_close($ch);

{

"id": "pay_IZTq8l_qaHuOHH",

"description": "Payment_123",

"amount": "199",

"currency": "PLN",

"state": "new",

"created_at": 1550224439,

"transaction_id": "tn_CLN2HhetI",

"payment_token": "573cf230-13df-4641-8d92-90c8b69173d0"

}

link EspagoFrame object params

| Parameter | Required | Type | Info |

|---|---|---|---|

| key | done | String |

Merchant public key |

| env | done | String |

Transaction environment, accepts values "production”,"sandbox”. |

| payment | done | String |

Payment id |

| token | done | String |

Payment token |

link Open method parameters

|Parameter |Required |Default value|Type| info|

| — | :—: |—- | — |

|onPaymentResult |done| | (result: { paymentId: string; state: string }) => void| Callback for payment process result which should accept an object containing payment id and state. |

|onError| done | | (error: string) => void| Callback for a payment process error which should accept an error message as string. |

|onClose| done | | () => void| Callback for iframe closing. |

|kind | | "espagoFrame" | String| The type of iframe to display. Values allowed: "espagoFrame", "applePayButton". |

One-time payment attach_money

link Charge parameters

A new charge is created after a POST request is send to https://sandbox.espago.com/api/charges. The transaction needs to be executed with the use of one of the afformentioned methods of passing on card details (make sure you are sending the apprioprate requests with correct parameters).

| Parameter | Description | Details |

|---|---|---|

| description | Transaction decription | Has to consist of 5 to 99 characters. |

| amount | Transaction amount | Floating point number, np. 123.45 |

| currency | Currency | Three-character long currency symbol, compatible with currently used MID |

| client | client ID | ID of a client (when charging an existing client) |

| card | token ID | ID of a token (in case of a one-time payment) |

| channel | Payment channel | Payment channel for this payment request. Defaut value is “elavon_cc” |

| recurring | [optional] [deprecated] |

Parameter is deprecated, you should use cof=storing instead. Adding parameter “recurring=true” enforces classification of transaction in bank as recurring transaction. This results in not checking the 3D-Secure. |

| complete | [optional] | Adding parameter “complete=false” enforces making only reservation of payment. See details in separate chapter. |

| moto | [optional] | Adding parameter “moto=true” enforces classification of transaction as MOTO (Mail Order/Telephone Order), for example when hotel owner recieved card number for charge from booking service. This results in the omission of 3D-Secure. Before using please contact the Espago Tech Team, using MOTO need to be playced in agreement betwen Merchant and Acquirer. |

| cvv | [optional] | Sending CVV in this format - “cvv=cv_xxxxxxxxxx” enables you to add CVV to a payment processed through an already existing client profile (when the original CVV has been “used”). Details in CVV tokens. |

| positive_url | [optional] | URL to which the client will be redirected to after successful payment processing |

| negative_url | [optional] | URL to which the client will be redirected to after unsuccessful payment processing |

| reference_number | [optional] | Trans ref text - visible in Elavon reports. Length up to 20 characters, only alphanumeric and - (minus and underscore). |

| locale | [optional] | Language code in ISO 639-1 standard. Two-letter string value. Language used in web page and/or in email notification. If language is not supported, english is used. |

| Client’s E-mail address | Client’s E-mail address required for 3D Secure authentication. Additionally a notification about the charge’s result will be sent to this address unless the skip_email parameter is present. If the parameter is used with a customer profile with an e-mail address, the address sent in this parameter has a priority and is used for sending notification. String variable. |

|

| skip_email | [optional] | Disables email notifications - even if you send a request charge with a customer profile with an email address. Boolean (false/true, default: false). |

| cof | [optional] | The use of “Card on file” mechanism. Possible parameter values: storing (saving card data in the form of a client profile, which can be used later for payments with tokens, or (when used with client profile) updating referenced sca_payment in client profile), recurring (information for the bank that this payment is a part of a subscription service, for use in payments processed with the use of a client profile), unscheduled (transaction requested by Merchant, for example customer billing for the service). Details in COF section. |

| recurring_expiry | [optional] | This parameter will be used if cof has the value of storing. The date on which the recurring payment expires (no more charges will be carried out) Accepted Format: YYYYMMDD. If cof=storing and this parameter is not set, then by default card expiry date is used. NOTICE: during 3-D Secure flow, on Bank site this parameter can be displayed. |

| recurring_freq | [optional] | This parameter will be used if cof has the value of storing. Indicates the minimum number of days between recurring charges. Integer value. If cof=storing and this parameter is not set, then by default recurring_freq=1 is used. NOTICE: during 3-D Secure flow, on Bank site this parameter can be displayed. |

| authentication_ind | [optional] | Type of later transactions, described in part 3-D Secure. |

| challenge_ind | [optional] | Enforcing SCA, described in part 3-D Secure. |

| payment_referenced | [optional] | The reference to a initial payment other than the one saved in the client’s profile. Takes the value of the payment ID. The parameter can only be used with cof = recurring orcof = unscheduled. By default, for recurring payments, the payment saved in the client’s profile is used (visible as sca_payment in the client’s profile), saved during the payment with the parametercof = storing |

| storing_for | [optional] [applies only to the elavon_cc channel] |

Indicates the type of recurring transactions for which the card stored within the Client Profile will be used. This parameter will be used when the payment is initiated with the cof=storing parameter. Available values: unscheduled, recurring. Defaut value is “unscheduled”. |

link Charge example

{

"amount": 10,

"currency": "pln",

"card": "cc_772ahSzjmMnOt4eIk",

"description": "Espago docs"

}

curl -i https://sandbox.espago.com/api/charges \

-H "Accept: application/vnd.espago.v3+json" \

-u ms_771eUTliRiZ:SeCreT_P@ssw0rD \

-d "amount=10" \

-d "currency=pln" \

-d "card=cc_772ahSzjmMnOt4eIk" \

-d "description=Espago docs"

require 'net/http'

require 'uri'

require 'json'

class EspagoClient

# @param user [String]

# @param password [String]

def initialize(user:, password:)

@user = user

@password = password

end

# @param path [String]

# @param body [Hash, nil]

# @param method [Symbol]

# @return [Net::HTTPResponse]

def send(path, body: nil, method: :get)

uri = URI.join('https://sandbox.espago.com', path)

request = request_class(method).new(uri)

request.basic_auth(@user, @password)

request['Accept'] = 'application/vnd.espago.v3+json'

request['Content-Type'] = 'application/json'

request.body = body.to_json if body

Net::HTTP.start(uri.hostname, uri.port, use_ssl: true) do |http|

http.request(request)

end

end

private

# @param [Symbol]

# @return [Class<Net::HTTPRequest>]

def request_class(method_name)

Net::HTTP.const_get(method_name.to_s.capitalize)

end

end

client = EspagoClient.new(user: 'ms_771eUTliRiZ', password: 'SeCreT_P@ssw0rD')

response = client.send(

'api/charges',

method: :post,

body: {

amount: 10,

currency: 'pln',

card: 'cc_8a1kqN20X6JYeuD-Y',

description: 'Espago docs'

}

)

puts response.body

$ch = curl_init();

curl_setopt($ch, CURLOPT_URL, 'https://sandbox.espago.com/api/charges');

curl_setopt($ch, CURLOPT_RETURNTRANSFER, 1);

curl_setopt($ch, CURLOPT_POSTFIELDS, "amount=10¤cy=pln&card=cc_772ahSzjmMnOt4eIk&description=Espago docs");

curl_setopt($ch, CURLOPT_POST, 1);

curl_setopt($ch, CURLOPT_USERPWD, 'ms_771eUTliRiZ' . ':' . 'SeCreT_P@ssw0rD');

$headers = array();

$headers[] = 'Accept: application/vnd.espago.v3+json';

$headers[] = 'Content-Type: application/x-www-form-urlencoded';

curl_setopt($ch, CURLOPT_HTTPHEADER, $headers);

$result = curl_exec($ch);

if (curl_errno($ch)) {

echo 'Error:' . curl_error($ch);

}

curl_close ($ch);

{

"id":"pay_773ob8rbBtid0PYd",

"description":"Espago docs",

"channel":"elavon",

"amount":"10.00",

"currency":"pln",

"state":"executed",

"client":"cli_7733nQkDLdlhHmh-",

"created_at":1561990343,

"card":{

"company":"VI",

"last4":"4242",

"year":2020,

"month":2,

"first_name":"Adam",

"last_name":"Adam",

"authorized":null,

"created_at":1561990328

},

"issuer_response_code":"00",

"reversable":true,

"transaction_id":"tr_773OKuy0b"

}

More info about responses can be found here.

{

"id": "pay_772LFdT3JG6KaAir",

"description": "order_481",

"channel": "elavon",

"amount": "9.99",

"currency": "PLN",

"state": "new",

"client": "cli_772mtwcEVYBfRCJ2",

"created_at": 1560935536,

"card": { ... },

"issuer_response_code": "",

"transaction_id": "tr_772atPpUX",

"redirect_url": "https://sandbox.espago.com/3d-secure/tr_772atPpUX",

"tds_redirect_form": { ... }

}

link 3D Secure

linkWhat is 3D Secure?

3D Secure is a transaction authorisation method used in the web. It redirects users to their bank’s site (or show iFrame) for additional authorisation (through SMS, submitting some credentials or confirmation on mobile phone application).

The use of 3-D Secure transfers from the Seller to the Customer’s Bank possible liability for fraud.

Proper handling of cards with 3D Secure is necessary for correct transaction flow.

_3d_secure.png)

Charges for clients using 3D Secure have the status parameter set to new and an additional parameter - redirect_url. It’s value is equal to the URL to which the user should be redirected to (for authorisation on the bank’s site). After redirecting the transaction’s status will be set to tds_redirected.

After successfuly finishing the required authorisation process, the client will be redirected back to the appropriate merchant’s site (postitive URL / negative URL). Details concerning the transaction will be submitted to the back_request URL.

Until 2019, 3-D Secure v1.0.2 was the standard, currently EMV 3-D Secure v2.2.0 is being introduced. From the customer’s point of view, the difference is small, but for the Merchant, there are:

- Many available parameters that could better adjust the 3DS authentication to a given type of transaction or business through paremeterauthentication_indandchallenge_ind.

- Authorization on amount “0” EUR/USD/etc, usefull for storing card data with authentication without charging customer.

- In payment with thecof = storingflag, SCA is always enforced (i.e. customer redirection and his conscious authorization of the transaction). In one-off payments, the Bank may, based on the data of the browser and / or mobile device, decide to authorize and redirect the customer to the store immediately without customer’s action (the so-called frictionless flow, e.g. for amounts below EUR 50, at a seller with whom customer has already made purchases, etc.).

For standard payments (one-time, recurring), Espago sets the appropriate parameters for 3-D Secure v2 authentication. In specific situations the Seller has the option to trigger a payment with additional 3DS indications.

| Parameter used in charge request | Description | Notes and values |

|---|---|---|

| authentication_ind | type of transactions for which authentication applies Default: “01” for single payment “04” for payments with cof=storing |

Need to be 2 digits. Possible values: ‘01’: ‘Payment transaction’ ‘02’: ‘Recurring transaction’ ‘03’: ‘Instalment transaction’ ‘04’: ‘Add card’ [usefull when used with unscheduled payments (ex. payments after renting a bike), should be used in initial transaction( cof=storing)‘05’: ‘Maintain card’ ‘06’: ‘Cardholder verification as part of EMV token ID&V’ |

| challenge_ind | Forcing mode for Strong Customer Authentication (SCA) Default: “01” for single payment “04” fored allways for payments with cof=storing (no possibility to change challenge_ind during storing) |

Need to be 2 digits. Possible values: ‘01’: ‘No preference’ ‘02’: ‘No challenge requested’ ‘03’: ‘Challenge requested (3DS Requestor preference)’ ‘04’: ‘Challenge requested (Mandate, for example due to PSD2)’ ‘05’: ‘No challenge requested (transactional risk analysis is already performed)’ ‘06’: ‘No challenge requested (Data share only)’ ‘07’: ‘No challenge requested (strong consumer authentication performed)’ ‘08’: ‘No challenge requested (utilise whitelist exemption if no challenge required)’ ‘09’: ‘Challenge requested (whitelist prompt requested if challenge required)’ |

| storing_for | Applies only to the elavon_cc channel. Indicates the type of recurring transactions for which the card stored within the Client Profile will be used. If the parameter is not used, its value defaults to “unscheduled”. |

Possible values: “unscheduled” [if the following recurring transactions will be initiated with the parameter cof=unscheduled] “recurring” [if the following recurring transactions will be initiated with the parameter cof=recurring] |

linkCardholder’s personal data required for Visa 3D Secure authentication

Starting from August 12, 2024, Visa will increase the amount of data required for 3D Secure authentication. From this date, for each 3D Secure transaction, the Merchant will be required to submit the cardholder’s email address.

Depending on the form of integration, the email address can be provided:

- as the value of the

emailparameter for transactions initiated via an API request to the /api/charges or /api/secure_web_page_register endpoints - as the value of the

emailparameter for transactions initiated via an HTML form - as the value of the

emailparameter in the Client’s Profile

link eDCC

linkWhat is eDCC?

Dynamic Currency Conversion (DCC) is a service that enables international Visa® and MasterCard® cardholders the choice to pay the bill in their own currency rather than the local currency.

PDCC from Elavon can convert MasterCard® and Visa® credit and debit transactions in up to 45 currencies — more than any other payment processor — you have more opportunity to grow revenue with us.Your customers will be able to see the actual amount they will be charged before finishing the transaction.

The eDCC service will not be called for recurring payments (recurring = true). The cardholder does not take part in the recurring payment, so he can not make a DCC decision. In this case - when using card in a different currency than the currency of the service for recurring payments, currency conversion will be made by card issuer bank - and according to its rules.

linkeDCC - how does it work?

_edcc.png)

1. Information about currency choice

The transaction begins as normal. If the merchant has got the eDCC service, the Espago gateway automatically discerns if the card qualifies for currency conversion.

If the card is suited for DCC transactions, the gateway responds and waits for the customer’s decision. The response in DCC transaction will always show the amount in the merchant’s currency, the conversion rate and the actual amount of charge (in customer’s currency). A payment waiting for the customer’s decision gets the parameter of status=dcc_decision.

If the card is not suited for DCC, the payment continues without interruptions.

curl -i https://sandbox.espago.com/api/charges \

-H "Accept: application/vnd.espago.v3+json" \

-u ms_771eUTliRiZ:SeCreT_P@ssw0rD \

-d "amount=49.99" \

-d "currency=pln" \

-d "client=cli_772uWYtgJXnL_F9I" \ # A customer with a card with a different currency

-d "description=Description"

require 'net/http'

require 'uri'

require 'json'

class EspagoClient

# @param user [String]

# @param password [String]

def initialize(user:, password:)

@user = user

@password = password

end

# @param path [String]

# @param body [Hash, nil]

# @param method [Symbol]

# @return [Net::HTTPResponse]

def send(path, body: nil, method: :get)

uri = URI.join('https://sandbox.espago.com', path)

request = request_class(method).new(uri)

request.basic_auth(@user, @password)

request['Accept'] = 'application/vnd.espago.v3+json'

request['Content-Type'] = 'application/json'

request.body = body.to_json if body

Net::HTTP.start(uri.hostname, uri.port, use_ssl: true) do |http|

http.request(request)

end

end

private

# @param [Symbol]

# @return [Class<Net::HTTPRequest>]

def request_class(method_name)

Net::HTTP.const_get(method_name.to_s.capitalize)

end

end

client = EspagoClient.new(user: 'ms_771eUTliRiZ', password: 'SeCreT_P@ssw0rD')

response = client.send(

'api/charges',

method: :post,

body: {

amount: 49.99,

currency: 'pln',

client: 'cli_772uWYtgJXnL_F9I',

description: 'Opis transakcji'

}

)

puts response.body

$ch = curl_init();

curl_setopt($ch, CURLOPT_URL, 'https://sandbox.espago.com/api/charges');

curl_setopt($ch, CURLOPT_RETURNTRANSFER, 1);

curl_setopt($ch, CURLOPT_POSTFIELDS, "amount=49.99¤cy=pln&client=cli_772uWYtgJXnL_F9I&description=Opis transakcji");

curl_setopt($ch, CURLOPT_POST, 1);

curl_setopt($ch, CURLOPT_USERPWD, 'ms_771eUTliRiZ' . ':' . 'SeCreT_P@ssw0rD');

$headers = array();

$headers[] = 'Accept: application/vnd.espago.v3+json';

$headers[] = 'Content-Type: application/x-www-form-urlencoded';

curl_setopt($ch, CURLOPT_HTTPHEADER, $headers);

$result = curl_exec($ch);

if (curl_errno($ch)) {

echo 'Error:' . curl_error($ch);

}

curl_close($ch);

{

"id": "pay_7724xNjCpNPWYevy",

"description": "order_502",

"channel": "elavon",

"amount": "17.98",

"currency": "PLN",

"state": "dcc_decision",

"client": "cli_772KDwdXQIbqpFp3",

"created_at": 1560942887,

"card": { ... },

"issuer_response_code": "",

"transaction_id": "tr_772_lDLkv",

"dcc_decision_information": {

"cardholder_currency_name": "HKD",

"cardholder_amount": "39.74",

"conversion_rate": "2.210174",

"redirect_url": "https://sandbox.espago.com/secure_web_page/tr_772_lDLkv",

"mark_up_percentage": "300"

}

}

| Parameter | Description | Notes |

|---|---|---|

| cardholder_currency_name | Name of the cardholder’s currency | in ISO 4217 |

| cardholder_amount | The amount in cardholder’s currency | |

| conversion_rate | Conversion rate | |

| redirect_url | eDCC decision made at Espago | Redirect the customer to this URL if th eDCC decision is not to be made on merchant’s site |

| mark_up_percentage | Mark up percentage |

2. eDCC descision

To charge the user send a POST request to https://sandbox.espago.com/api/charges/(:id)/dcc_decision

(:id) - Id of the payment awaiting for a DCC decision

Responses are the same as in regular transactions (without eDCC) - only with additional information about the currency and amount.

curl -i https://sandbox.espago.com/api/charges/(ID_TRANSAKCJI)/dcc_decision \

-H "Accept: application/vnd.espago.v3+json" \

-u ms_771eUTliRiZ:SeCreT_P@ssw0rD \

-d "decision=Y"

require 'net/http'

require 'uri'

require 'json'

class EspagoClient

# @param user [String]

# @param password [String]

def initialize(user:, password:)

@user = user

@password = password

end

# @param path [String]

# @param body [Hash, nil]

# @param method [Symbol]

# @return [Net::HTTPResponse]

def send(path, body: nil, method: :get)

uri = URI.join('https://sandbox.espago.com', path)

request = request_class(method).new(uri)

request.basic_auth(@user, @password)

request['Accept'] = 'application/vnd.espago.v3+json'

request['Content-Type'] = 'application/json'

request.body = body.to_json if body

Net::HTTP.start(uri.hostname, uri.port, use_ssl: true) do |http|

http.request(request)

end

end

private

# @param [Symbol]

# @return [Class<Net::HTTPRequest>]

def request_class(method_name)

Net::HTTP.const_get(method_name.to_s.capitalize)

end

end

client = EspagoClient.new(user: 'ms_771eUTliRiZ', password: 'SeCreT_P@ssw0rD')

payment_id = 'pay_8a1FKrxqzJG9sszX'

response = client.send(

"api/charges/#{payment_id}/dcc_decision",

method: :post,

body: {

decision: 'Y'

}

)

puts response.body

$ch = curl_init();

curl_setopt($ch, CURLOPT_URL, 'https://sandbox.espago.com/api/charges/(ID_TRANSAKCJI)/dcc_decision');

curl_setopt($ch, CURLOPT_RETURNTRANSFER, 1);

curl_setopt($ch, CURLOPT_POSTFIELDS, "decision=Y");

curl_setopt($ch, CURLOPT_POST, 1);

curl_setopt($ch, CURLOPT_USERPWD, 'ms_771eUTliRiZ' . ':' . 'SeCreT_P@ssw0rD');

$headers = array();

$headers[] = 'Accept: application/vnd.espago.v3+json';

$headers[] = 'Content-Type: application/x-www-form-urlencoded';

curl_setopt($ch, CURLOPT_HTTPHEADER, $headers);

$result = curl_exec($ch);

if (curl_errno($ch)) {

echo 'Error:' . curl_error($ch);

}

curl_close($ch);

{

"id": "pay_77219xeZ-8xvxUdE",

"description": "order_523",

"channel": "elavon",

"amount": "39.96",

"currency": "PLN",

"state": "executed",

"client": "cli_772KEkYX7Vq54DJe",

"created_at": 1560949080,

"issuer_response_code": "00",

"reversable": true,

"transaction_id": "tr_7722-YsY6",

"multicurrency_indicator": "Z",

"dcc_decision_information": {

"cardholder_currency_name": "HKD",

"cardholder_amount": "88.32",

"conversion_rate": "2.210174"

}

}

multicurrency_indicator - Information about the transaction currency. Field present only if the payment currency is different from the currency of the site.

N - Card without DCC

Y - DCC canceled by the user

Z - DCC is possible and accepted by the user

link3D Secure and eDCC

Sometimes a customer using 3D Secure may want to pay in another currency. For this reason, you need to take it into consideration the possibility of such a scenario - when a customer first makes a DCC decision and gets redirected to the URL with 3D Secure. After displaying the information about conversion, the Espago gateway responds with a 3D Secure redirection URL, while the payment gets the “tds_prtcpt” status.

Expample response

{

"id": "pay_7724l5jFs9EP6Xr0",

"description": "order_526",

"channel": "elavon",

"amount": "16.98",

"currency": "PLN",

"state": "tds_prtcpt",

"client": "cli_772TVMYGxKECDKPZ",

"created_at": 1560953142,

"issuer_response_code": "",

"transaction_id": "tr_772C5ke_m",

"redirect_url": "https://sandbox.espago.com/3d-secure/tr_772C5ke_m",

"tds_redirect_form": { ... },

"multicurrency_indicator": "Z",

"dcc_decision_information": {

"cardholder_currency_name": "HKD",

"cardholder_amount": "37.53",

"conversion_rate": "2.210174"

}

}

linkFetching conversion rates

In some situations, when the Seller expects most customers to use eDCC, he can send a request for conversion rates to the Espago gateway. Thanks to this, there is a way to inform the customer about the conversion rate for his transaction before even starting it!

Conversion rates are updated every day at 6:30 PM.

In order to fetch the conversion rates send a GET request to https://sandbox.espago.com/api/dcc/rates.

curl -i https://sandbox.espago.com/api/dcc/rates \

-H "Accept: application/vnd.espago.v3+json" \

-u ms_771eUTliRiZ:SeCreT_P@ssw0rD

require 'net/http'

require 'uri'

require 'json'

class EspagoClient

# @param user [String]

# @param password [String]

def initialize(user:, password:)

@user = user

@password = password

end

# @param path [String]

# @param body [Hash, nil]

# @param method [Symbol]

# @return [Net::HTTPResponse]

def send(path, body: nil, method: :get)

uri = URI.join('https://sandbox.espago.com', path)

request = request_class(method).new(uri)

request.basic_auth(@user, @password)

request['Accept'] = 'application/vnd.espago.v3+json'

request['Content-Type'] = 'application/json'

request.body = body.to_json if body

Net::HTTP.start(uri.hostname, uri.port, use_ssl: true) do |http|

http.request(request)

end

end

private

# @param [Symbol]

# @return [Class<Net::HTTPRequest>]

def request_class(method_name)

Net::HTTP.const_get(method_name.to_s.capitalize)

end

end

client = EspagoClient.new(user: 'ms_771eUTliRiZ', password: 'SeCreT_P@ssw0rD')

response = client.send "api/dcc/rates", method: :get

puts response.body

$ch = curl_init();

curl_setopt($ch, CURLOPT_URL, 'https://sandbox.espago.com/api/dcc/rates');

curl_setopt($ch, CURLOPT_RETURNTRANSFER, 1);

curl_setopt($ch, CURLOPT_CUSTOMREQUEST, 'GET');

curl_setopt($ch, CURLOPT_USERPWD, 'ms_771eUTliRiZ' . ':' . 'SeCreT_P@ssw0rD');

$headers = array();

$headers[] = 'Accept: application/vnd.espago.v3+json';

curl_setopt($ch, CURLOPT_HTTPHEADER, $headers);

$result = curl_exec($ch);

if (curl_errno($ch)) {

echo 'Error:' . curl_error($ch);

}

curl_close($ch);

{

"timestamp":"2017-12-01T04:48:00.000+01:00",

"mark_up_percentage":"300",

"currency_name":"PLN",

"currency_code":"985",

"rates":{

"USD":"0.285413",

"ARS":"2.546572",

"RON":"1.136708",

"CZK":"6.997923",

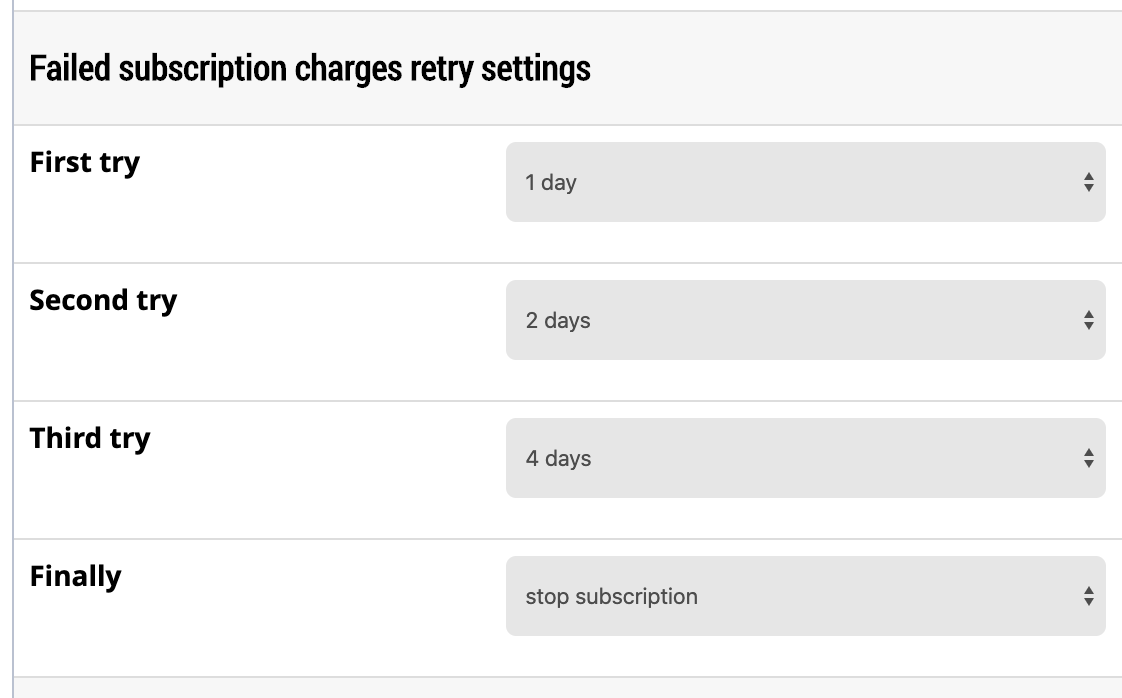

"EUR":"0.255955",